CORPORATE

ABOUT US

CMX GOLD & SILVER CORP.

CMX Gold & Silver Corp. holds the Clayton Silver Property in the U.S.A. through its wholly-owned Idaho-incorporated subsidiary, CMX Gold & Silver (USA) Corp.

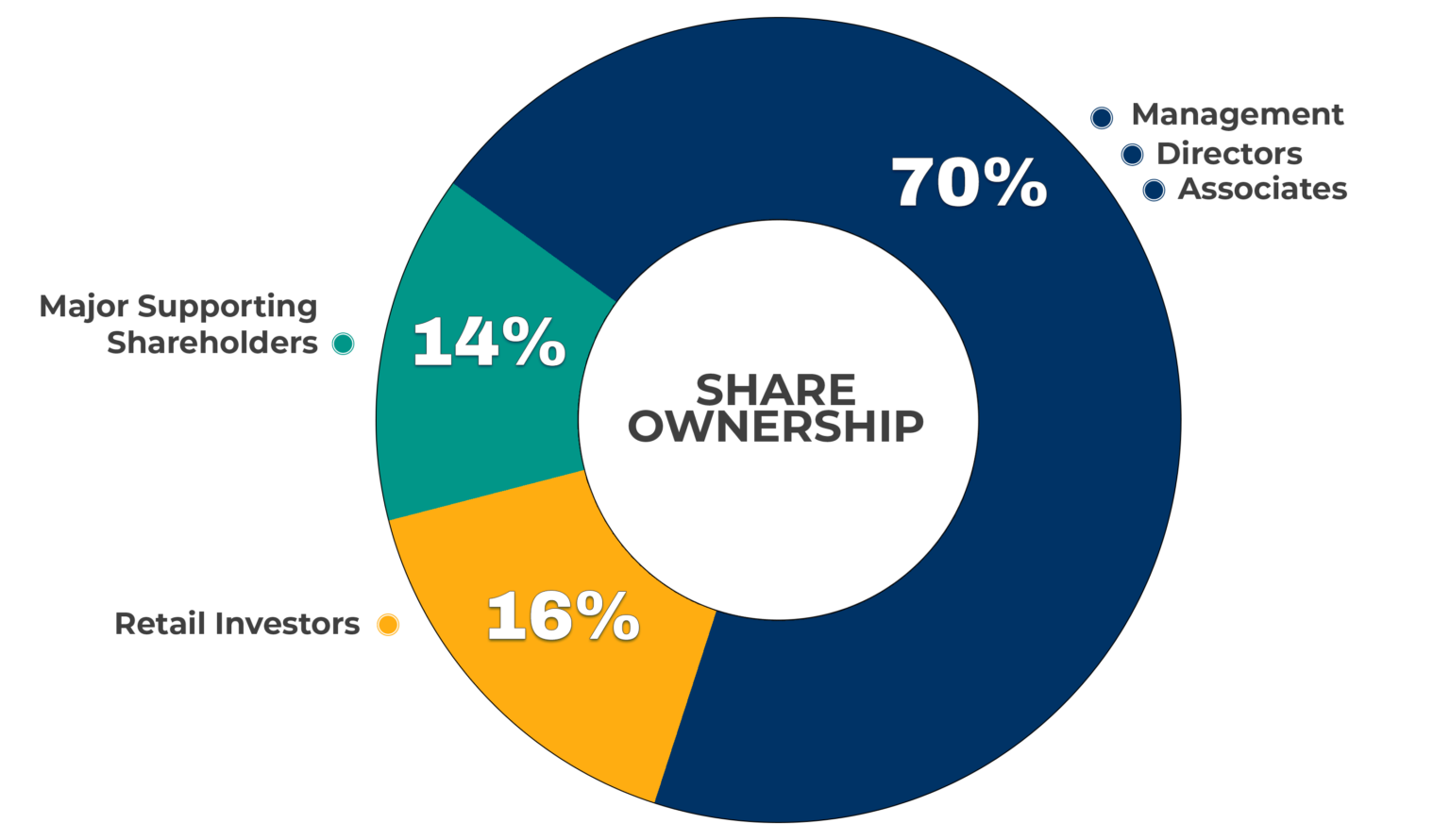

As of December 2025, Management, directors (including their family members) and associates have a significant share position in CMX and own 70% of the 74,486,224

issued and outstanding Common Shares. Other major supporting shareholders hold 14% of the Common Shares.

CMX Expands Clayton Landholdings

During 2022 the Company staked 22 new unpatented claims on BLM land to the north, east and south of the current land holdings. The staking was completed in November 2022. Subsequent to the 2023 year end, the Company was informed by the U.S. Bureau of Land Management that some of the claims staked in 2022 contiguous to its Clayton Mine property overlaid portions of seven historic claims staked in 1993. These claims are in the vicinity of the historic Rob Roy mine immediately north of the Clayton patented claims. This means that the Company’s new lode claims are subject to adjustment, which is expected to reduce the acreage by up to 103 acres. Prior to carrying out the staking program, the Company researched whether there were any claims records on the subject BLM lands in the vicinity of CMX’s patented claims. The Company’s investigation did not reveal that any older claims existed. Local public records did not flag the old claims. CMX is currently assessing the full effect this has on the Clayton Mine land position. Based on current information, the Company’s aggregate land holdings for the Clayton Silver Project have been adjusted to 1,028 acres. An important part of the Company’s strategy is to gain control of land surrounding the Clayton Mine prior to starting a drilling program.

Plans and Status for The Clayton Silver Project

Although the Clayton property was a producing mine until 1986, the property is considered to be an early-stage project as the Company has not completed any programs to assess the resource potential.

The Company anticipates commencing work programs in early 2025, extending over the next several years to:

- assess the resource potential within, and immediately adjacent to, the structures hosting the previously mined sections (i.e., the North and South Zones), and

- undertake exploration to identify and determine the potential

for additional mineralized zones in adjacent (i.e., en echelon) structures.

Planned work will entail detailed geophysical work, including Induced Polarization/Magnetotellurics and Self Potential methods, and multiple follow-up drilling programs within, and along, the known mineralized system. The Company has found little evidence for exploration beyond the existing mine workings and no evidence that geophysics was done has not been utilized on the property historically.

The Company plans to commence geophysical work in Spring 2025. The proposed geophysical survey is expected to delineate known structures and potentially identify other new ore bodies within and below the existing underground workings (currently flooded), and provide an initial evaluation of the surrounding prospective claims held by the Company. The survey will provide detailed subsurface data to strategically locate subsurface targets or Diamond Drill Sites (DDS) on the Issuer’s 100%-owned property. Interpretation and evaluation of the geophysics is expected to identify optimum DDS. The program is expected to include a Direct Current Induced Polarization Survey (DCIP) and a Magnetotelluric Survey (MT).

In addition the Company controls a large stockpile (estimated at 1,000,000 tonnes or more) of unprocessed mineralized rock that was tested for metals in 2014. The Company is seeking to realize near term value by processing the mine stockpile, utilizing precision ore sorting technology to enhance the grade of material in the stockpile. Ore sorting is a proven technology utilized successfully around the world to recover metals from historically mined material. The application of precision ore-sorting technology to the Clayton Mine stockpile will enhance the grade of material to a high-grade concentrate delivered to a toll mill. Testing in 2022 confirmed the Company’s expectation that ore sorting would enhance the grade of the stockpile material. The Company plans to install a custom TOMRA ore-sorting system on the Clayton property, subject to financing, with which to process the stockpile.